Comes back to the understaffing issue, again.

Even if you have good dependable space, due to lack of good govermental vegetation management the fires are at such a catastrophic level, the large embers cast and intense heat will just blow through the D.S.

Early in my career, a wise CDF old timer, just getting to retire at the end of the season, told me; “Son, you’re going to see fires like never before seen. The political destruction of the logging industry, and the extremely poor laws preventing nearly any forest management, the fires are going to be catastrophic. A big fire now days is 25- 35k acres. Son that’s going to be the norm. and you’re going to see loss of life and property like never b4.” I kind of thought he was just tired and the fires seemed bigger. That was until I went to the Lexington fire and they’ve only gotten bigger and more intense. This issue has been building for decades and the insurance industry has been hit hard by it. This, and with all the political issues in this state, makes it hard to do business. Not trying to create a right or wrong regarding politics, just basic facts.

One thing that seems to get glossed over is building material, vent screening, fire resistant siding, paints, ect. In alder springs 5 homes survived ember cast then flaming front with 1 receiving direct flame impingement. They all have comp siding, vent screening. Roofing is metal, tile, and comp.

No, that’s not it. No amount of resources were going to stop the Camp Fire, or make the fireground less chaotic.

I understand, I think, your point. No amount of sandbags could have filled the breach at the 9th Ward. But better arguments, and a more assertive and direct attitude on the part of people trying to get the flood gate on Pontchartraine built, might have. The ACE has as much as said so.

If you’re telling me, no epic fuel break would have saved Paradise, I believe you. If FS had the crews to get the break done at Grizzly Flats, might that sort of thing have softened the blow? Would more resources (crews, crews, crews) help reduce the shock from Piper last year? I’d like to think so.

More resources, specifically, more full-time all-year firefighters, fuels crews, better quality inspections (where experience and paid hours of employment is the factor), make a difference in many other (even most?) cases? Insurance cos are surely looking for that at some level, and it may have a positive effect on insurance rates, locally. It would seem the confounding effect of poor inspection and lack of all-hazard ff resources (specifically crews) is putting a lot of surrender flags in the air that don’t necessarily need to be there.

Can you get the measure or bill passed that’s going to save you on the insurance rates by spending half the amount on resources? Is that an argument with merit in the minds of the taxpayers? I’d like to think so.

But, I’m not a homeowner in the places where the danger is greatest. Could be that the picture looks a little different west of the I5 and south of Redding.

I hope this makes some sort of sense, and I’m not just parading ignorance about details.

Where there is risk, and an individual, or family, or small business, says, “The government doesn’t know what to do with my money, I don’t want a nanny state, I’ll take the risk.” They really aren’t taking the financial risk, the insurance company is, and they are going to charge you for it, plus the premium to the CEO and the shareholders for the pleasure of doing business with them, and you’re going to pay that whether the fire or flood happens or not. That’s what I’m trying to say.

The Placer County Office of Emergency Services urges residents to attend events in their local area and participate in their local Firewise community district, which could result in receiving a fire insurance discount from the California Department of Insurance.

You would think that lack of coverage options for homeowners would bring prices down considerably. Negative Ghost rider.

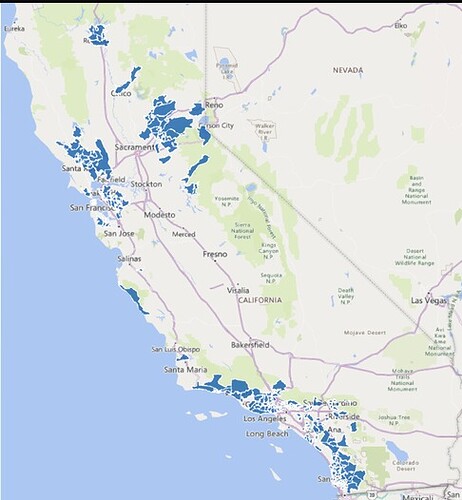

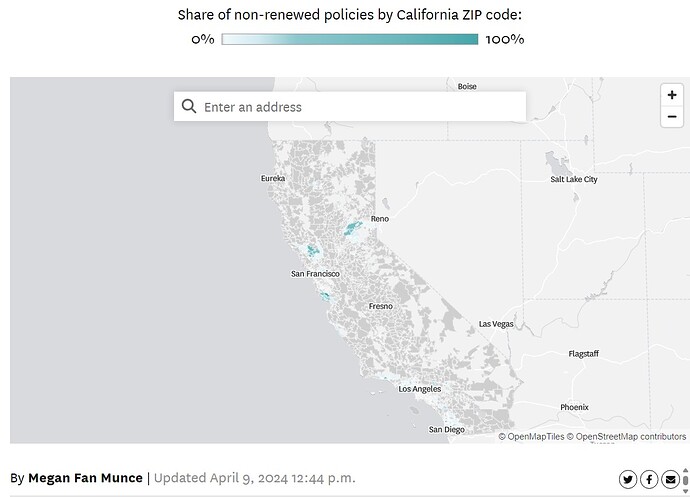

KTVU’s map of the zip codes with the highest numbers of non-renewals.

State filing shows California zip codes where State Farm plans to drop policy holders (ktvu.com)

Does that have a chronological tab to pull down? Haha, I bet the Sierras were dropped first, now Bay Area and SoCal residents. Pretty soon Jake at State Farm won’t have to put a commercial out in California

Yeah, IDK. Three things you can count on, I think…situational awareness, straight leg hand crew and water. Where these three data points are the grid, there is material cause for hope and habitability.

SF Chronicle zoom map with more detail and commentary about places and fires.

California map: ZIP codes State Farm won’t renew insurance policies (sfchronicle.com)

I thought we were self insured, guess not.

It might be interesting to know which two stations and what the factors are.

Correct, im going with a contract station or special arrangement with a property owner

One was Ishi CC. Apparently, in order to sell the bonds to build it insurance is required. So maybe self-insurance not allowed by the underwriting. All the state did was go forward paying it with cash.